Our firm's China Outbound Investment product was launched in 2008 with a view of providing (to the extent possible) "primary source reconciled data" related to Chinese outbound investments. We did so after hearing so many corporate and institutional investors question the transparency or sources of such data appearing in numerous public sources.

We monitor all Chinese outbound investment across continents, industries and by type/component of investment – both equity and debt. Since the data pre-dates the BRI, this data covers the globe, not just the original 65 OBOR counties, or to the circa 140 countries which are now public (we do not include bank loans by Chinese commercial banks, unless linked to a policy bank).

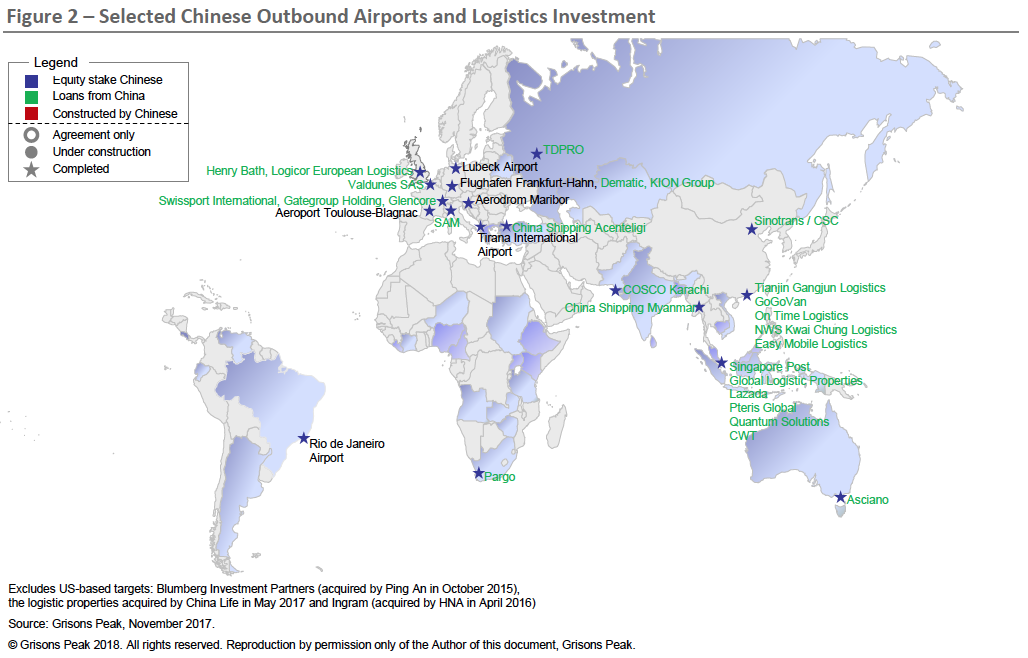

"To paraphrase Confucius, you must study the past to understand the future."

..... Read more

Click on image to open presentation

From the March 2017 GOSS Forum onwards both attendees and critics of the BRI have consistently queried us on financial returns of and funding for the BRI project. Our firm is keen to play a role to assisting to help raise international funding to support a BRI funding gap, which, at the current time, shows declining quarterly policy loan commitments, pressure on Chinese commercial banks balance sheets and a majority of projects not designed to produce positive cash flows for a number of years.

While it has not been possible to fully analyse all 350+ projects in our 10-year old database (without external funding), over the past year, we have been able to complete 3 different BRI investment returns studies across a number of projects already during H1 2018:

- Cambodia (March) – This paper examines how China and Cambodia, a key Southeast Asian BRI country, have collaborated in almost textbook fashion to implement a small scale version of the Chinese economic growth model. This paper initially analyses 16 projects including 6 renewable energy projects and 10 infrastructure projects, during the period of 2011-2017, all funded by Chinese partners. The combination of efficiently managed Chinese infrastructure spend to further lift an economy already ranked 6th globally in average GDP growth and possessing a stable government has produced an even more attractive environment for corporate investors across countries and industries.

- United Nations (May) – a study of 12 operating projects which are both operational and revenue producing from 2011

- Selected Ports (June) – case studies for both China Merchants and Cosco’s financial performance for their respective investments in Colombo (Sri Lanka) and Pireaus (Greece) ports as well as the “halo effect” of their success has had on developing the local economies, including real estate values in Sri Lanka and uplifting GDP in both countries

UNECE International PPM Forum May 2018 Selected Successful BRI Projects

"Our Grisons Peak presentations are designed to both improve understanding of the BRI, and whenever possible, provide insights on investment returns on specific projects in order to attract future BRI investors.

In this presentation to the United Nations, we focus on successful infrastructure and renewable energy projects across 12 countries. As you will see, many of these have been backed by Chinese policy bank loans. To have been included in this small sample, the project needed to operational, produce revenues and provide some financial information which could be verified, thus most of these started on our slightly before the official launch of BRI.

It is important to note that this presentation is only a small subset of the hundreds of projects we have tracked since 2008, the year we launched our database. As such, readers can expect additional analyses as more projects become revenue producing. Investors can also expect "halo effect" analyses on some projects as real estate values around such projects, especially ports/port cities have demonstrated substantially increased prices/returns as port flows increase."

Chinese purchases of overseas ports top $20bn in past year

China is ramping up acquisitions of overseas ports as it expands its reach as a maritime power, doubling its investments in port projects over the past year to $20bn and pushing ahead with plans to open new shipping routes through the Arctic circle. Read More .....

4 April 2017 – China outbound M&A picks up in March after subdued months

Rising M&A activity in March boosts outlook for easing of China’s capital curbs

30 March 2017 – Goldman, Lazard China Dealmakers Decamp for Upstart Funds

Top Goldman, BofA, Lazard bankers leave as advisory fees drop

by Cathy Chan and Jonathan Browning

Veteran China dealmakers at Wall Street banks and Western buyout firms are heading for the exits, in search of the more lucrative deals and higher remuneration offered by smaller funds.

Three senior merger advisory bankers from Goldman Sachs Group Inc., Bank of America Corp. and Lazard Ltd. have resigned within the past month for senior roles at fledgling investment funds, according to people familiar with their departures, who asked not to be identified discussing private information. Carlyle Group LP Managing Director Alex Ying left the firm in January after two decades to set up Rivendell Partners, which focuses on mid-sized buyouts in Greater China and Vietnam, other people said. Read More ......

The fDi Podcast: China restrictions on overseas investment already biting

Beijing reinstated limits on overseas investment in a push to limit the flow of hot money out of the country. ICBC's Helena Huang and Grisons Peak's Henry Tillman discuss with fDi deputy editor Jacopo Dettoni how these restrictions have already limited the activity of Chinese investors in Europe and the US, and add uncertainties over the final outcome of ongoing and future deals. Watch the Podcast

An Analysis of Short-Term Performance of UK Cross-Border Mergers and Acquisitions by Chinese Listed Companies

Abstract: