Exporting the Chinese Model to BRI Countries: Cambodia as a Case Study Henry Tillman Chairman of China Investment Research

Executive Summary

Exporting the Chinese Model to BRI Countries: Cambodia as a Case Study

Henry Tillman

Chairman of China Investment Research

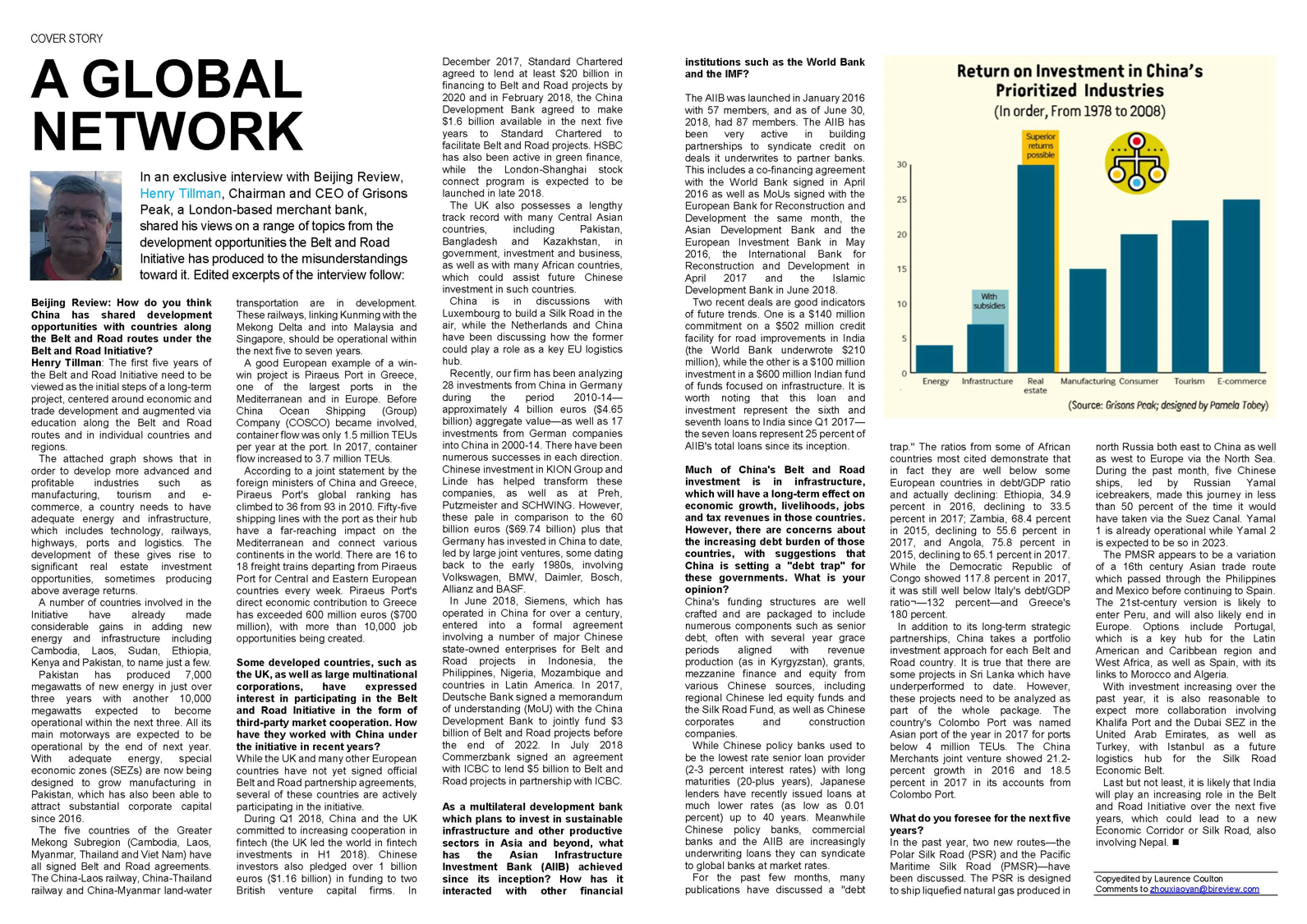

This paper examines how China and Cambodia, a key Southeast Asian BRI country, have collaborated in almost textbook fashion to implement a small scale version of the Chinese economic growth model. Within a decade, Cambodia now has sufficient energy to support an already growing economy as well as sufficient infrastructure to begin to attract corporate investments, initially from China and then across a number of other countries and sectors.

This paper initially analyses 16 Phase 1 projects (defined below) including 6 renewable energy projects and 10 infrastructure projects, during the period of 2011-2017, all funded by Chinese partners. We then analyse the Chinese Government related funding used by in these projects through which we conclude that Cambodia’s debt to GDP increased from circa 28% in 2008 to circa 35% in 2015, via a carefully managed mixture of G2G loans and grants, Mekong Delta regional fund pledges, policy bank loans and Chinese corporate investments.

The combination of efficiently managed Chinese infrastructure spend to further lift an economy already ranked 6th globally in average growth and possessing a stable government has produced an even more attractive environment for corporate investors across countries and industries. FDI increased by 25% during 2016; momentum which continued into 2017. While China has represented the lead FDI investor (we analyse Chinese corporate investments by sector and by specific investments over $1 billion) there has also been increased investment from major corporates based in Japan, Korea, Hong Kong, Singapore and France.

Predictably, this recent surge in FDI has now moved beyond (Cambodia’s garment) manufacturing, but into construction and real estate (which has led to credit expansion), consumer and tourism, sectors which can meet private equity return thresholds. READ MORE......

3 October 2017 Henry Tillman: Financing China’s Belt & Road Initiative on this joint event with the Confucius Institute Henry Tillman will outline China’s financing arrangements for this long term, high growth initiative.

Henry Tillman, Founder and CEO, Grisons Peak Description The Belt and Road Initiative (BRI) outlined by China’s President Xi Jinping is one of the most significant and substantial investment and development programmes to come out of China since the building of the Great Wall. Join us to develop an overview of the financing arrangements made by China for this long-term, high-growth initiative.

Our speaker, Henry Tillman, has an international business career spanning almost 35 years. The founder, Director and CEO of Grisons Peak - a London-based Asia-focused merchant bank - in 2008 he also set up China Outbound Investments which tracks and analyses G2G agreements, Chinese Government related loans, and M&A/equity investments.

In his talk he will provide information on:

• Chinese policy bank loans (2013-2017)

• New banks (AIIB, NDB and SCO Bank)- and how these banks are becoming multi-lateral

• Chinese use of Green Bond market

• Use of other financing instruments such as Securitisation, NPLs.

While many ratings agencies question China’s ability to fund this growth, data accrued by China Outbound Investments shows how they are doing so, and how such financing techniques have evolved over the past few years

An Analysis of Short-Term Performance of UK Cross-Border Mergers and Acquisitions by Chinese Listed Companies

Abstract:

Reports

Chinese Outbound Investments into US (2004-2012)

Co-Authors:

Petter N. Kolm, Corant Institute, New York University, and the Heimdall Group, LLC New York, United States Henry T. Tillman, Chairman and Chief Executive Officer, Grisons Peak LLP, London, United Kingdom (Views set forth in this document are the views of the authors and not necessarily of their respective institutions)

Overview

This study analyses Chinese outbound investment into the US since 2004, the year when the Chinese made their initial major acquisition of a US owned organisation. The empirical data is from 2004-2011 inclusive, and extends across M&A/equity investments as well as major Bank Loans and major Trade Agreements. The data has been assembled solely from public sources, and in many cases, from the Grisons Peak China Outbound database.

In this study, we posit that there are three distinctive stages of Chinese outbound investments into the US:

-

2004-2006 – Initial Phase

-

2007-2009 – Financial Services brands via Equity/Funds Investments

-

Post Financial Crisis – A Shift to Trade Agreements

SSRN Research Rankings:

As of August 2016, the China into US M&A research paper ranked in the top 9% of all SSRN research based upon total downloads. Author rankings was in the top 19%, again based on total downloads.

Academic Research

2022

2021

- September: Addressing the Vaccine Gap: Goal-based Governance and Health Silk Road – SIIS | China Investment Research, Shanghai University

- May: Health Silk Road 2020: A Bridge to the Future of Health for All – SSRN | was recently ranked on SSRN's Top Ten download list for: PSN: Access to Care (Topic).

- April: Hong Kong Trade and Development Belt and Road webpage (as well as HKTDC’s mirror sites/related social media). Health Silk Road 2020: A Bridge to the Future of Health for All

- March: Shanghai Institute of International Studies (SIIS) (Shanghai): Health Silk Road 2020: A Bridge to the Future of Health for All

Author: Henry Tillman, Yang Jian and Ye Yu – China Investment Research (CIR) and Shanghai Institute for International Studies (SIIS)

- February: University of Macerata (Italy): Course: Global Markets and Chinese economy

2020

- Sino-German Center at Frankfurt School of Finance (September 2020) Experiences of German FDI in China

- Journal of Contemporary European Studies (June 2020) Polar Silk Road and EU; review manuscript

- China Data Analysis & Research Hub (CDA) Vienna, Austria – Member Advisory Board

- BRI in Oman as an example: The Synergy of Infrastructure, Digitisation and SEZs authors Henry Tillman, YANG Jian, YE Qing (December 2019)

- The Polar Silk Road China's New Frontier of International Cooperation which has been published in CHINA QUARTERLY OF INTERNATIONAL STRATEGIC STUDIES

- Exporting the Chinese Model to BRI Countries: Cambodia as a Case Study: Private Equity Review – Case Study; PE REVIEW ISSUE IV; Goss Research Management (Hong Kong); NUS National University of Singapore; RMI Advanced Risk Management for Singapore and Beyond (March 2018)

- Funding the Belt and Road; Edinburgh University, the Scotland Confucius Institute (October 2017)

- An Analysis of Short-Term Performance of UK Cross-Border Mergers and Acquisitions by Chinese Listed Companies; City University London – Sir John Cass Business School; Grisons Peak provided all of the data to Cass for its analysis; joint author (November 2016)

- Chinese Outbound Investments into US (2004-2012) Co-Authors: Petter N. Kolm, Corant Institute, New York University, and the Heimdall Group, LLC New York, United States Henry Tillman, Chairman and Chief Executive Officer, Grisons Peak LLP, London, United Kingdom (2013)